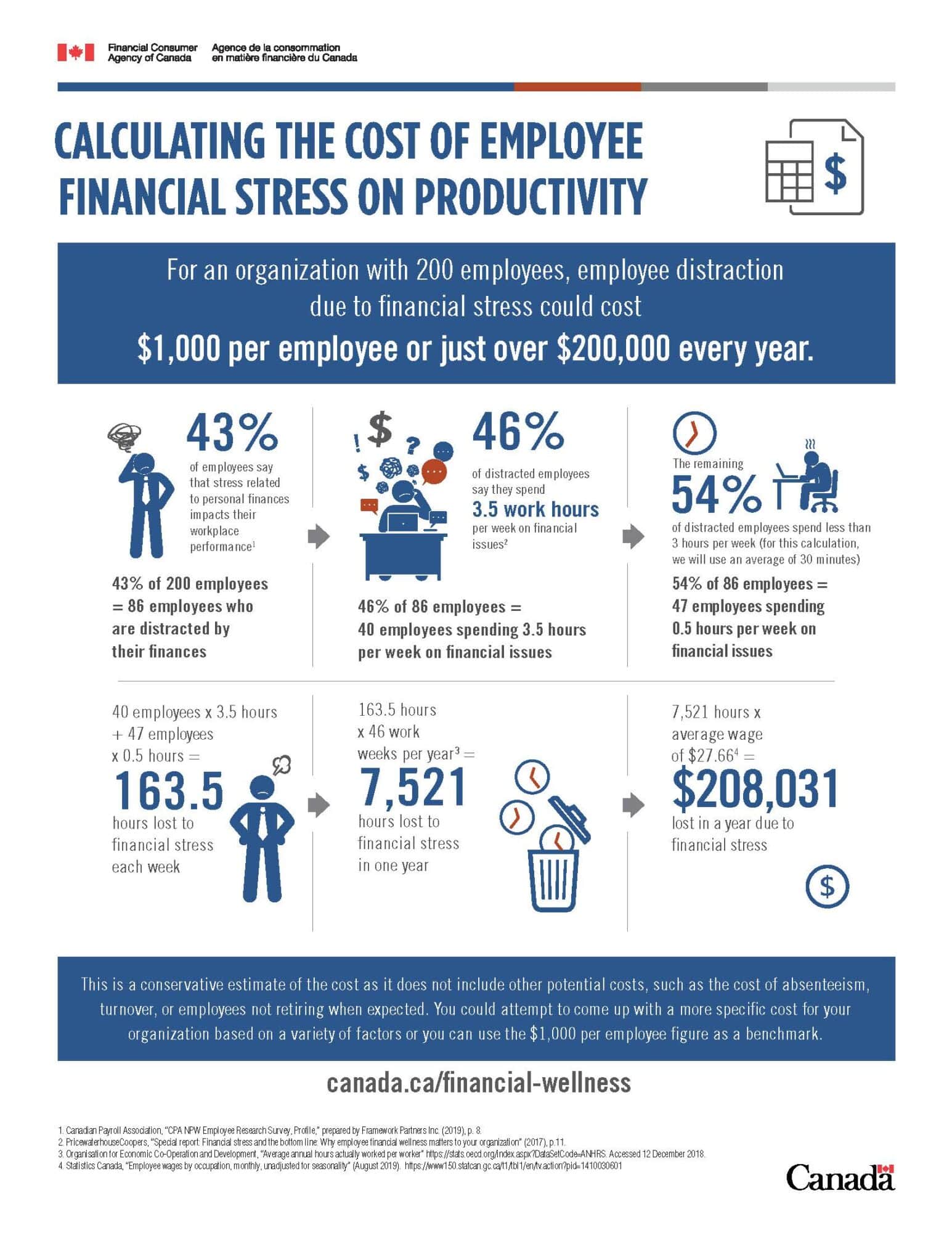

According to Manulife’s Financial Wellness Assessment, many Canadian workers feel unprepared as they near retirement age and 45% of Canadians feel distracted at work because of financial worries. For a company of 200 employees, employee distraction due to financial stress could cost $1000 per employee, or just over $200,000 every year. Clearly, employees’ personal financial stress takes a toll on productivity which has a financial impact on employers.

- Finances are a major source of stress for most Canadians.

- This stress can take a toll mentally and physically.

- 43% of employees say that stress related to personal finances impacts their workplace performance.

- Thousands of weeks of lost employee productivity per year due to financial stress.

- Hundreds of thousands in lost wages per year due to employee financial stress.

- Individuals who are financially prepared are more likely to be healthier.

What does this “financial stress distraction” mean for employers?

Here is data provided by the Financial Consumer Agency of Canada on the cost of employee financial stress on productivity.

If your employees are unsure of where they personally stand financially, helping them with their financial wellness and assisting them to prepare for retirement can potentially result in positive outcomes for your business by:

- Reducing employee stress and distraction

- Improving employee wellness

- Boosting productivity

As an employer, you’re in a position to encourage your plan members to think about their personal financial situations and the aspects of living in retirement. Most employees will trust the advice and recommendations provided by their employers related to financial products, services, or organizations. Employers who provide comprehensive tools to support financial wellness — from savings, debt management and asset protection, to tools and educational support — can help employees improve their current and retirement readiness.

Health Risk Services can recommend several different tools that will assist you in supporting your employee’s financial health – today’s recommendation is to provide your employees with a Group RRSP – Registered Retirement Savings Plan. These programs are a collection of individual plan member RRSPs administered together. It has no legislative requirement for employers to contribute, but you do have the option.

A group RRSP helps plan members:

- Save more of their money for retirement —contributions are tax deductible and investment earning are tax-sheltered until withdrawal

- Choose investments to help save for retirement no matter what their investment knowledge or interest level—from simple to customized solutions

- Gain access to their funds to buy a first home (Home Buyers’ Plan) or for education

(Lifelong Learning Plan)

- Conveniently contribute through payroll deductions and save tax immediately

- Build their retirement savings by matching their contributions

With the right Group RRSP, you can provide your employees with the resources to create a financial plan to help improve their financial outlook. We will discuss the many benefits of the Group RRSP in an upcoming HRS Blog, so please stay tuned.

At Health Risk Services we will Empathize, Educate, and Empower you and your team in 2021!

To schedule your Complimentary Consultation with Health Risk Services, please call

403-236-9430 OR email: [email protected]