A registered retirement savings plan (RRSP) is a government-approved account that allows Canadians to plan for retirement. First introduced in 1957, RRSPs provide a way for individuals to save and invest their money in a tax-efficient manner. Annual contributions to an RRSP can be used as a tax deduction, which reduces the amount of tax a person will pay on their income. In addition, all capital gains and dividends aren’t taxed a long as the money remains in the RRSP.

How does an RRSP work?

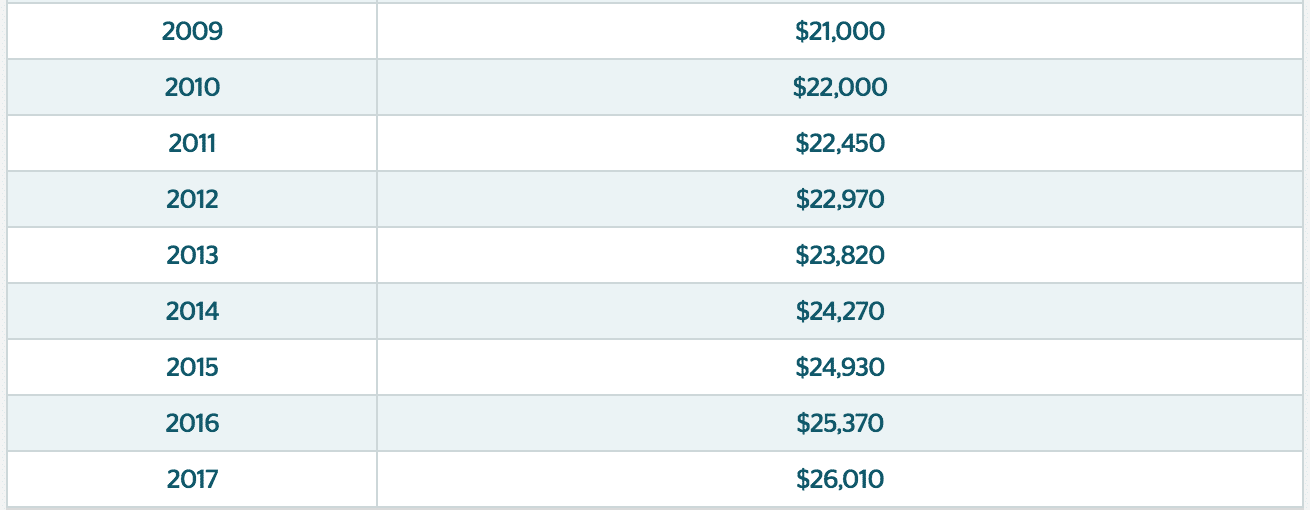

Every year, Canadians with “earned” income (salaries or wages from a job) who file a tax return may contribute money to an RRSP. The contribution limit is defined as either 18% of your previous year’s earned income or a specified amount set by the Canada Revenue Agency (CRA), whichever is less. Here are the annual contribution limits since 2009:

Year Contribution Limit

This contribution may then be used as a deduction when filing for the previous year’s taxes. For example, if you contribute $2,000 to your RRSP, your income is then reduced by $2,000 for the purpose of calculating the tax you owe.

Canadians are permitted to hold a wide variety of investments in their RRSPs. Some common RRSP investments include:

- Stocks listed on major Canadian foreign exhanges

- Bonds (government and corporate)

- Savings bonds

- GICs

- Mutual Funds

- Exchange-traded Funds (ETFs)

- Index Funds

- Cash

- Gold and silver bars

- Income trusts

RRSPs may remain open until a person reaches the age of 71. At this point (by the end of the calendar year), they must be closed or converted into what’s known as a registered retirement income fund (RRIF).

If you would like more information or would like to discuss your RRSP in detail please contact our office at: 403-236-9430