CELEBRATING 25 YEARS OF BUSINESS EXCELLENCE!!

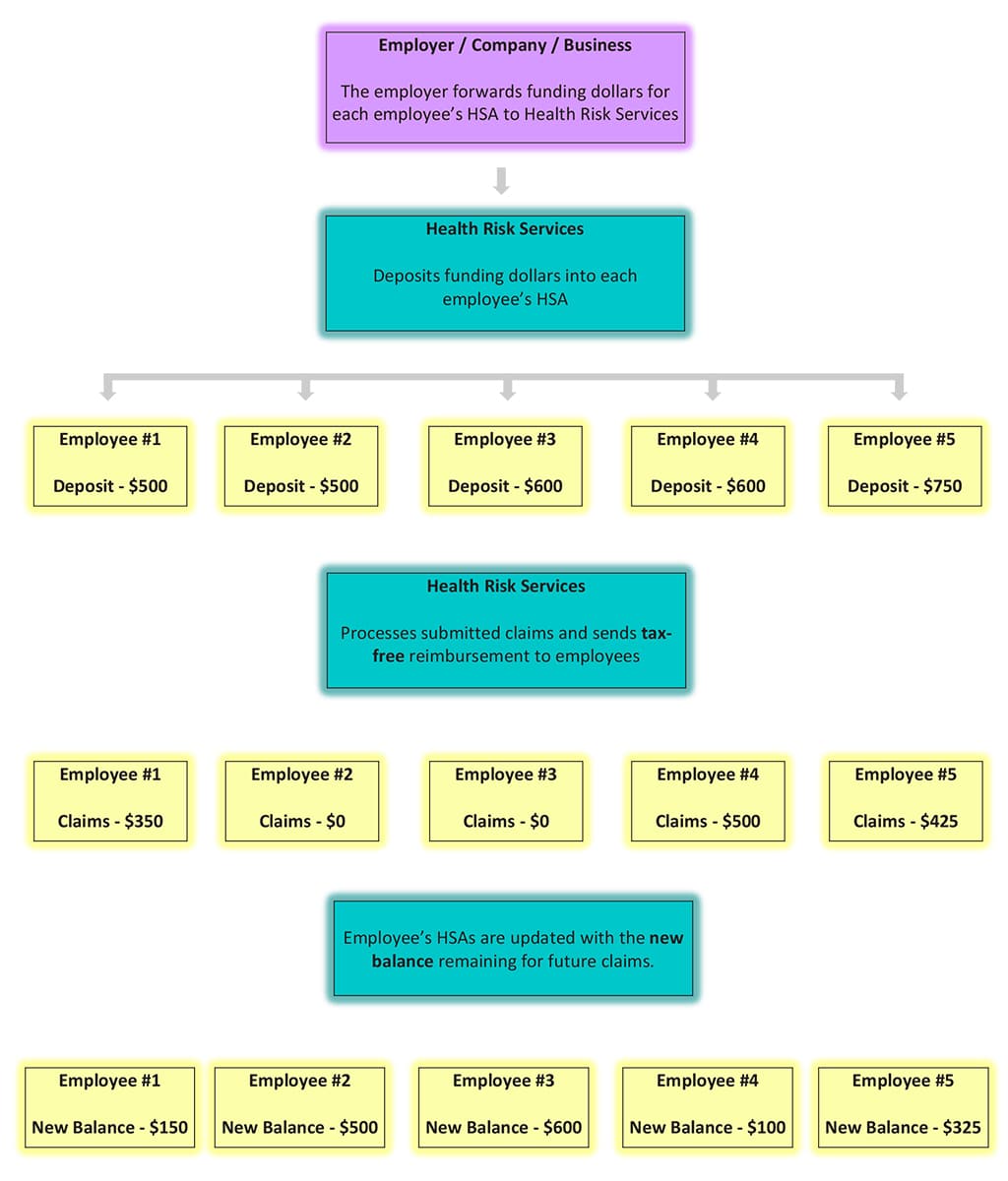

An HSA resembles a personal bank account as it works with debits and credits. With a positive account balance, an individual may obtain reimbursement for eligible medical and dental expenses and the account is debited by the paid amount. The amount deposited into each account must be used within a specified period (1 or 2 years), after which an unused balance is forfeited. This “use it or lose it” principle is required by Revenue Canada for the HSA to qualify as a private health services plan and is necessary to maintain a reasonable element of risk in the benefit plan for insurers.

There are three main areas of consideration when implementing an HSA – Philosophy, Carry Forward and Funding.

Philosophy: Should the company have a program that has a tiered benefit structure for different groups of employees in the organization? HSAs could be structured based on seniority or position within a company such as different benefit amount for executives, management and all other employees.

Carry Forward: The design of an HSA is determined by the method of “carry forward” that is selected by an employer. There are three options by which an HSA is constructed:

Funding: the employer’s pre-determined contribution amount can be allocated to fund an employee’s HSA in one of the following options:

Certain criteria must be met for an HSA to be considered a tax-deductible business expense, the same as a traditional benefit plan.

Incorporated business, limited companies or self-employed individuals and their families are eligible for HSAs. Claims may be submitted for eligible expenses which are incurred by an eligible employee, their spouse or any other dependent for which the employee is claiming a tax deduction in the taxation year the expense was incurred.

We CARE about insisting that your plan stays current with CRA guidelines.

We CARE about providing you with all the proper plan implementation documents for your corporation to ensure compliance with CRA.

We CARE about ensuring quick turnaround times for your claims.

We CARE about providing you with the convenience of direct deposit for your reimbursements.

We CARE about ensuring you are kept up to date on any legislation changes that may affect your Health Spending Accounts.

In other words, we CARE about your overall Benefit Plan experience!

Contact HRS today to enquire about implementing YOUR Employee Benefit Plan!